Amidst challenging environment, the Company remained resilient and paved its way forward with ‘New TM’ transformation to set the Company on a sustainable growth trajectory

Telekom Malaysia Berhad Group of Companies (TM Group) today concluded its 36th Annual General Meeting (36th AGM) with all 12 Ordinary Resolutions tabled duly approved by its shareholders. The Meeting, conducted via online for the 2nd consecutive year in view of the Movement Control Order (MCO), saw virtual participation by more than 1,000 shareholders.

Commenting on the proceedings, Tan Sri Dato' Seri Mohd Bakke Salleh, Chairman of TM said: "We are very pleased that TM once again was able to conduct its AGM virtually and engage with our shareholders without being physically present at the meeting venue. This reflects our commitment towards ensuring the safety and health of our shareholders as well as stakeholders by complying with the guidelines set by the Securities Commission Malaysia (SC), National Security Council (NSC) and Ministry of Health (MoH)."

Also participating in the online AGM was Imri Mokhtar, Managing Director / Group Chief Executive Officer, TM as well as other members of the TM Board. Razidan Ghazalli, Group Chief Financial Officer, TM was also present.

"Amidst the market and pandemic challenges, we remained resilient and recorded an improvement in our 2020 performance, as our cost optimisation initiatives continue to drive profitability. Building on current momentum, we have embarked on the next phase of our exciting journey with the 'New TM' Transformation Programme. Guided by our compass of Purpose, Customers, Performance and People, we will focus on Connectivity Excellence, Solutions Excellence and Customer Experience Excellence to set us apart from the competition," added Tan Sri Dato' Seri Bakke.

The 'New TM' transformation is anchored on 40+ Value Programmes, driven by a dedicated Transformation Office; with a new cadence towards a higher execution tempo, which is already showing early traction. TM is also reshaping its workforce into a stronger execution engine, embracing a more agile work culture with future-ready skills.

This will set TM on a sustainable growth trajectory, to create shareholder value and continuously enable a more Digital Malaysia. TM, in its role of enabling Digital Malaysia, is ready to support the Government's digitalisation agenda, particularly the Jalinan Digital Negara (JENDELA) and the comprehensive Malaysia Digital Economy Blueprint – MyDIGITAL as well as other Government's digital and stimulus plans, towards accelerating the socio-economic recovery and fast-track the nation into a technologically-advanced economy by 2030.

TM is well positioned to play a significant role in MyDIGITAL – focusing on digital connectivity (fibre, 5G, international connectivity), digital infrastructure (Cloud, Data Centre and Cybersecurity) as well as digital skillsets and talents (via Multimedia University and TM Digital Academy). The Company was also appointed as the sole Malaysian Cloud Service Provider (CSP) under MyDIGITAL, at par with the other global players.

TM believes that such public and private collaboration will propel the country towards a full-fledged Digital Malaysia by 2030 – a more digital society, digital business, digital industry and digital Government.

Despite the MCO, TM was able to publish a fully Integrated Annual and Sustainability Report (IAR) for this year. The theme of this year's IAR is "Reach Further", a reflection of the ripple effect brought about by the report cover. The idea is to inspire Malaysians to go further in pursuing their dreams through Digital Malaysia, as reflected through the visuals in the separators of a Digital Society, Digital Businesses and Digital Government presented in the book. This theme and narrative are carried consistently from our report cover, separators and throughout the strategic narrative of the report.

To read and download TM's IAR 2020, visit https://tm.com.my/investor-relations/financial-information/annual-reports.

YOU MAY ALSO LIKE

TM Wins Asia Best Employer Brand Awards 2023

KUALA LUMPUR, 3 October 2023 – TM is proud to have received the Best Employer Brand Award at the prestigious Asia Best Employer Brand Awards held in Singapore recently. The award acknowledges TM’s commitment to nurturing employee growth, continuous learning, and fostering a high-performance culture. Commenting on the award, Sarinah Abu Bakar, Chief Human Capital Officer, TM said, “Our TM employees are the driving force behind our success. The recognition at Asia Best Employer Brand Awards 2023 reaffirms our dedication to the growth and well-being of every Warga TM. People are at the core of our business strategy. This investment in our workforce is not solely targeted at their personal and professional development, but also aims to instil the right competencies that underpin our business performance. The award reflects our relentless pursuit of excellence and transformation towards becoming a TechCo, not only in Malaysia but also throughout the region.” “On behalf of TM’s management team, I would like to extend our heartfelt gratitude to all Warga TM, whose dedication and hard work have made this achievement possible. Our unwavering commitment to becoming the best and an exceptional employer continues as we aspire to grow and succeed together,” Sarinah concluded. Nurturing employee personal development and growth is an essential aspect of TM’s efforts that highlights HR’s pivotal role in shaping positive business outcomes. Over the years, TM has introduced a culture that values high performance, continuous learning and digitalisation, aligning with the Agile work approach to empower teams for greater flexibility and productivity. As TM steers towards the next level of growth, it remains committed to investing in future skills to further enhance the Company’s business performance. The Asia Best Employer Brand Awards 2023, hosted by the Employer Branding Institute and World HRD Congress, honour organisations for their exceptional contributions in talent management, development, and innovation. Award recipients were chosen by a panel of jury members following a comprehensive evaluation and assessment of their performance over the past 24-months.

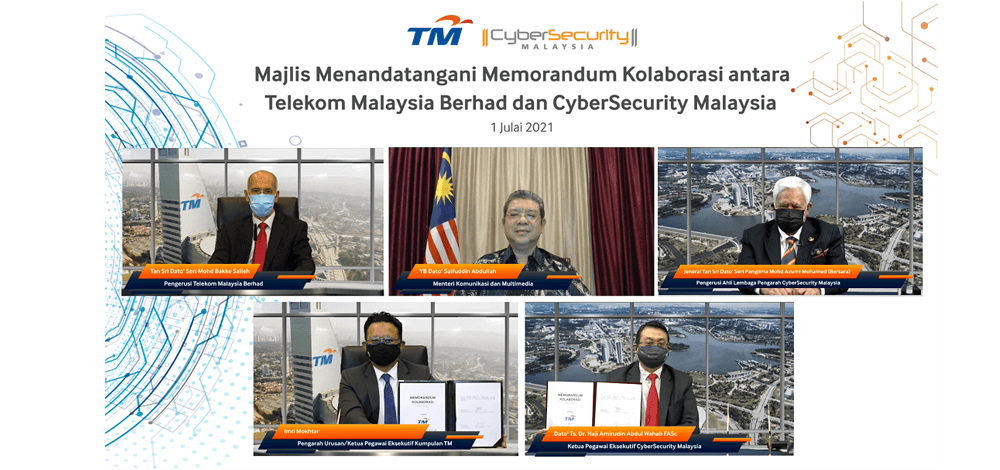

TM and Cybersecurity Malaysia join forces to strengthen national cyberspace resilience

Both companies will leverage each other’s expertise, technical capabilities and global best practices to create a safer and more robust cyber ecosystem. Telekom Malaysia Berhad (TM) via its enterprise and public sector business solutions arm, TM ONE, today sealed a Memorandum of Collaboration (MoC) with CyberSecurity Malaysia, the national cybersecurity specialist agency under the purview of the Ministry of Communications and Multimedia Malaysia (KKMM), to empower and strengthen the level of cybersecurity in Malaysia. The MoC was signed in a virtual event by Dato' Ts. Dr. Haji Amirudin Abdul Wahab FASc, Chief Executive Officer, CyberSecurity Malaysia and Imri Mokhtar, Group Chief Executive Officer (GCEO), TM. The ceremony was witnessed by General Tan Sri Dato' Seri Panglima Mohd Azumi Mohamed (Retired) Chairman of the Board of Directors, CyberSecurity Malaysia and Tan Sri Dato' Seri Mohd Bakke Salleh, Chairman of TM. The event was also graced by the presence of YB Dato' Saifuddin Abdullah, Minister of Communications and Multimedia Malaysia. Commenting on key aspects of the memorandum, Tan Sri Dato' Seri Mohd Bakke Salleh noted: "We are honoured to collaborate with CyberSecurity Malaysia in this strategic initiative, which is aimed at elevating the nation's cybersecurity network and ecosystem and strengthening Malaysia's self-reliance in cyberspace. It is vital for the adoption of cybersecurity to be in tandem with the pace of transformation in order to secure our digital economy. Being a strategic partner, it is our pleasure to lend our expertise not just for this initiative but in Malaysia's mission to enhance its cybersecurity capabilities. This collaboration will enable both parties to enhance the ability of the public and business sectors to fend off cyberattacks that can come from all corners of the world and make cybersecurity a key thrust towards a sustainable digital economy, digital government and digital society. TM as the enabler of Digital Malaysia, is here to bridge the need for cybersecurity in order to successfully use cloud services; and to enable organisations to focus on their transformation journey, securely and comfortably." Meanwhile, General Tan Sri Dato' Seri Panglima Mohd Azumi Mohamed (Retired) said, "As a cybersecurity specialist and technical agency, CyberSecurity Malaysia is strongly committed to ensure the e-Security aspects of the country and will continue to identify areas that could endanger national security and the well-being of the people. The main focus is to strengthen capacity through monitoring and providing effective response towards cyber threats and attacks to avoid major impact. With the signing of this strategic partnership, the principles and mechanisms of collaboration will enable both entities to merge and benefit from each other's technology and expertise, thus enabling both organisations to act as commercial strategic partners locally and internationally." The initiative between both parties includes the sharing of global best practices, leveraging each other's technical capabilities and is set to deliver optimal cybersecurity technology solutions to local enterprises and public sectors. TM's role encompasses offering end-to-end comprehensive cybersecurity solutions to both Malaysia and the world. This is delivered principally through CYDEC, which is a portfolio of active cyber defense capabilities, managed security products and services, powered by TM's Global Security Operations Center (GSOC). CYDEC is indeed paving the way for greater digital trust and cyber resilience in the digital era. These managed security services ensure access to real-time, continuous, predictive cybersecurity, quickly and without complexity, for added assurance and is well-positioned to secure and protect our nation's strategic Critical Network & Information Infrastructure (CNII). Another key aspect of this strategic collaboration is to explore the development of advanced security monitoring capabilities by tapping on TM ONE's extensive cloud infrastructure. Both parties will also endeavour to advance digital forensic capabilities and enhance incident response services. This will eventually feature cyber-outreach, a capability and capacity development programme, which will help to upscale the skillset and digital intelligence potential of Malaysia's public and private sector workforce. This MoC also signals the continued urgency of addressing the relentless surge of cyber threats impacting both the public and business sectors as a fundamental step to enabling a sustainable, safe and successful digital society. TM ONE CYDEC cybersecurity solution comprises four (4) key elements: Managed Security Service Provider – an end-to-end security solution and management in real-time through predictive protection on private or public networks Cybersecurity Subscription Service – a self-service Digital Risk Protection portal powered by a renowned global telecommunications player, Telefonica Digital Identity Services – provide authority certificates and digital signatures that comply with Malaysia's regulatory and legal systems Professional Services – offers holistic security consulting and assessment services on an organisation's cybersecurity strategy and landscape For further information on TM ONE CYDEC cybersecurity solution, visit www.tmone.com.my/solutions/cybersecurity-services and for more info on CyberSecurity Malaysia, visit www.cybersecurity.my.

TM One-UC Tati collaboration to enhance Terengganu’s tech research and development; enables education equity for students in the state

The Master Services Agreement (MSA) between TM & UC TATI will enable the digital transformation initiatives of this state government university college TM One, the enterprise and public sector business solutions arm of Telekom Malaysia (TM), has signed a Master Services Agreement (MSA) with University College Terengganu Advanced Technical Institute (UC TATI) to provide high speed managed data and Internet services at its Teluk Kalong Kemaman Campus and Kuala Terengganu City Campus respectively, for the benefit and use by the students, lecturers and staff. The partnership, which includes a complete end-to-end package of both Wide Area Network and Local Area Network effectively enables wireless connectivity throughout the campuses, and is part of the Terengganu-based institution's efforts to enhance its digital research and development field, as well as delighting student experiences post pandemic. In particular, TM One’s high-speed Internet services will support the Terengganu Big Data Institute (BDIT) located at UC TATI to conduct research and activities related to public data for the university college and the Terengganu State Government. With this, TM One enables UC TATI to explore new digital technologies such as Cloud-Based Services, Public Data and Disaster Recovery Centres that will enhance student learning as well as potentially serve the local Government and surrounding communities. General Manager of State Sales for TM One, Jamalullail Mohd said, “This agreement symbolises the strong partnership between TM One and UC TATI to provide next gen connectivity services for more contextual teaching and learning experiences to students. The accelerated adoption of digitisation has impacted the lives of Malaysians everywhere, with access to fast and reliable Internet services becoming a necessity in households, workplaces and learning institutions. This collaboration ensures educational equity and equal access to students from all parts of the country and we are pleased to support UC TATI in their transformation.” "This collaboration will also be a catalyst for UC TATI in its digital transformation journey and is among the first steps for us to meet the IR 4.0 revolution. In addition to enhancing our research and development efforts into Big Data and other key technologies, this Internet service will enhance the university's operational efficiency, teaching and learning, and overall student experiences – especially for those who are resident on-campus. Working with TM One enables us to improve our capabilities and the quality of our services in these fields and to bring our institution into the next phase of its growth," explained Professor Dr. Anuar Bin Ahmad, Rector of UC TATI.