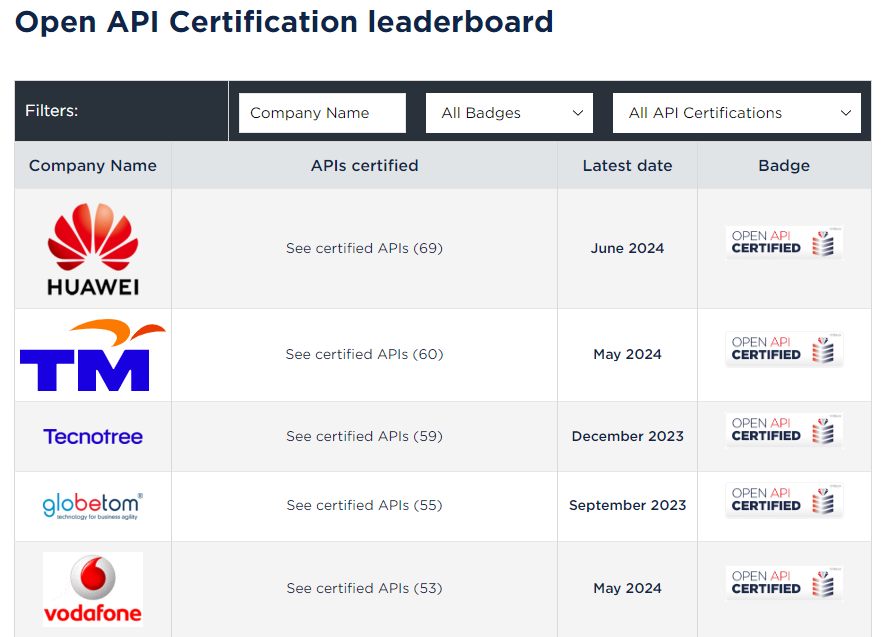

KUALA LUMPUR, 18 June 2024 – TM achieves TM Forum Open API Diamond Conformance Certification with 60 certified APIs, surpassing industry giants. This milestone underscores the company's commitment to industry standards and innovation.

TM Forum Open API enables seamless connectivity, interoperability and portability across complex ecosystem services. This “API-first” approach fosters collaboration and simplifies integration for developers. With over 770,000 downloads by over 2,700 companies worldwide, TM Forum’s Open APIs are a game changer for the industry. By achieving this certification, TM actively contributes to this global shift.

While at the TM Forum: Ignite conference in Copenhagen, Ivan Chong, TM’s Chief Information Officer (CIO) commented, “This certification aligns with our aspiration of becoming a Digital Powerhouse by 2030. We have established a reusable API framework, streamlined high-volume custom APIs and consolidated siloed API gateways into a single cohesive gateway, strengthening our platform play approach. This boosted our system response time by 34%, exemplifying a truly ‘plug and play’ technology capability.”

“The standardised Open APIs, tested in real-world deployment, enable faster time to market with 100% reusable and secure APIs from a curated catalogue. For example, by exposing API capabilities such as Digital Solutions to third-party partners, we can accelerate the development of new products and services for Smart Cities, Smart Education and Smart Healthcare. This fosters the creation of more innovative solutions and new revenue streams while adhering to global industry standards,” added Ivan.

TM's certification journey started with a Bronze in September 2023 with three APIs and quickly progressed to Diamond with 54 certified APIs in just seven months. Now at 60 certified APIs, TM demonstrates its dedication to agility, innovation, and collaboration.

By joining 11 of the world's largest service providers including Vodafone, China Mobile and Telefónica, who have adopted TM Forum's suite of Open APIs for digital service management, TM solidifies its global recognition among industry leaders.

YOU MAY ALSO LIKE

TM ONE LAUNCHES ITS INNOVATION LAB AND ENTERPRISE 5G LAB TO EMPOWER AND DRIVE DIGITALISATION IN THE ENTERPRISE AND GOVERNMENT SECTOR

CYBERJAYA, 20 FEBRUARY 2024 – TM One is proud to announce the launch of its Innovation Lab and Enterprise 5G Lab, designed to accelerate the realisation of ground-breaking digital services and solutions. These initiatives cater to the unique needs of Malaysia’s large enterprises and Government sector, fostering innovation and empowering digital growth opportunities for TM, its valued customers, partners and society. Officiated by Minister of Digital, YB Gobind Singh Deo, both labs will serve as hubs to bring together the latest technologies, digital leaders and inspiring ideas. It provides a secure, collaborative space where TM, its customers and partners can turn ideas into tailor-made solutions, creating opportunities in today’s rapidly evolving digital landscape. Amar Huzaimi Md Deris, TM’s Group CEO, said, “We are excited to launch our new Innovation Lab and Enterprise 5G Lab by TM One. This is a significant milestone of our commitment to drive innovation and deliver value to our customers, partners and the nation. Through these initiatives, we aim to foster greater industry collaboration, and propel key areas such as Enterprise 5G and Smart Services with AI to help organisations thrive in the digital age. “The launch of the Innovation Lab and Enterprise 5G Lab underscores TM's ongoing commitment to foster innovation and customer-centricity. It strengthens our role as a trusted partner for organisations seeking to harness the power of digital technologies, and drive growth and transformation within their businesses and wider communities,” he shared. Located at the state-of-the-art TM Digital Academy in Multimedia University, the Labs are the next in TM One’s continuous efforts to build collaborative ecosystems to drive equitable digital progress. Complementing this initiative is TM One’s 5G Sphere Partnership Programme, with partnerships with over 50 local and global entities to support the co-creation of new innovations. TM One’s Sandbox further provides a secure operational test-bed environment for these partners and customers to develop customised solutions. Both Labs enable: 1. Immersive Engagement: Beyond showcases, organisations will experience first-hand how TM One innovates solutions and delivers expertise for their specific needs. By experiencing potential solutions in action, customers can better grasp the implications and advantages to their own operations. 2. Dialogue & Knowledge Sharing: Having initial prototypes will encourage a deeper exchange of insights by various ecosystem players including TM One’s 5G Sphere partners, and other industry experts. 3. Accelerated Decision-Making: Live use-cases and knowledge sharing help expedite decision-making processes, empowering customers to make informed choices confidently. The Innovation Lab helps decision-makers address hurdles or uncertainties they may have about new technologies or services. 4. Tailored Relationships: Customers will receive a personalised, tailored experience, focusing on an organisation’s unique digital and business objectives, and how TM One can contribute to their success. Customers visiting the Innovation Lab and Enterprise 5G Lab will explore a diverse array of opportunities including the future of connectivity and digitalisation, as well as how technology will reshape industries and elevate the digital business landscape into a realm of boundless possibilities. For a first look at the TM One Innovation Lab and Enterprise 5G Lab, visit https://youtu.be/kg6CA16Khqk

YTM and Istana Negara equips higher risk communities with disaster preparedness

Facilitates the development of localised Emergency Response Plans Over the years, Yayasan TM (YTM) has been actively involved in disaster emergency response efforts and lent its helping hand to affected communities in various ways. With many tragic losses of life and property due to natural disasters, it is imperative to help the public better understand the importance of preparedness, the risks involved and build capacities for pre-emptive and early action, including identifying vulnerabilities and potential impact on people and assets. Through its latest initiative, the YTM-Istana Negara Community Based Disaster Risk Reduction and Management Programme (CBDRRM), organised in collaboration with Istana Negara, the programme is aimed at empowering communities especially women and children as well as building community resilience during disasters with the necessary knowledge and skills in disaster preparedness - in alignment to the Government's aspiration to nurture a disaster preparedness culture among Malaysians. For the inaugural edition of the programme, YTM identified three (3) high risk areas in Kuantan, Maran and Bentong districts in Pahang. This is also a continuation from the support to the local communities post-flood early this year where YTM, together with Istana Negara provided basic necessities, workforce and monetary assistance to citizens in Karak, Ulu Tembeling and Kuantan districts. “This CBDRRM programme is both important and timely, in view of frequent heavy rain and storms of late. We hope that the local communities will fully utilise the skills and knowledge obtained from the initiative, to be better prepared for in the event of any flood incidents in their respective areas, minimising the impact and ultimately, saving lives,” said Izlyn Ramli, Director of YTM. “We were delighted to find that these modules were very helpful for them based on their feedback. Meanwhile, we remain on the ready to deploy response and humanitarian aid should the need arise,” she added. The first one was held in August 2022 for the community in Perumahan Awam Kos Rendah (PAKR) Sungai Pandan, Kuantan, which saw a total of 120 participants attending, while the second was held in Maran in September. With the support of the National Disaster Management Agency (NADMA) as well as the TM Reaching Out Volunteers (TMROVers), the programme was conducted by 12 humanitarian experts with vast disaster response experience, including risk and reduction management from Red A Humanitarian Global. The modules highlighted the importance of disaster preparedness, hands-on session to develop localised Emergency Response Plans, water safety and practical swimming, as well as simulation exercises. The participants were also briefed on mental health management and creating children-friendly spaces (CFS) as an added element. For any emergency response plan to work, active participation from the community becomes crucial. During the programme, the communities were also connected to their local government agencies such as the Malaysian Fire and Rescue Department (BOMBA), Royal Malaysia Police (PDRM), Malaysia Civil Defence Force (APM), Jabatan Pengairan & Saliran (JPS) Negeri Pahang for better disaster response in the future. The third and final session was organised recently in Bentong in collaboration with Istana Negara and attended by 125 participants. Via the three (3) series of CBDRRM in Pahang, YTM have reached a total of 458 community members and local government agencies; inclusively, empowering 123 female participants and 167 children and teenagers. This initiative is aligned with our aspiration to build capacity in disaster preparedness among community members, especially women and children, who are considered first responders’ priority when a disaster occurs. YTM will continuously support the community for better disaster preparedness and response through community leadership and self-empowerment.

CONSOLIDATION OF TM’S BUSINESS IN MALAYSIA INTO TM TECH TO STRENGTHEN CONVERGENCE LEADERSHIP AND IMPROVE OPERATIONAL EFFICIENCY

Following the earlier communication on 14 December 2022, Telekom Malaysia Berhad (“TM”) today announced the internal reorganisation of its business in Malaysia into a single operating entity named TM Technology Services Sdn Bhd (“TM Tech”) following the approval of various bodies, including the High Court of Malaysia and the Malaysian Communications and Multimedia Commission. Effective today, 1st March 2023, Telekom Malaysia Berhad will serve as an investment holding company for this single operating entity (TM Tech), along with other wholly owned subsidiaries, covering TM’s international, digital, education, support business and other non-wholly owned subsidiaries. This group in totality will continue to be governed by the current TM’s Board of Directors and managed by the same Senior Management team. The reorganisation into TM Tech – which includes Unifi, TM One and TM Global, amongst others – marks the next phase of TM’s transformation that will reinforce its fixed-mobile convergence (FMC) position, further improve operational efficiencies and deliver a more seamless customer experience. Resource-wise, the reorganisation brings together the diverse talents, facilitating greater cross-functional collaboration and agility through more streamlined and simplified processes. Group CEO of TM, Dato’ Imri Mokhtar explained, “As customer demand, increasing competition and stakeholder expectations reshape the industry, it is timely to consolidate our telco business in Malaysia into a single operating entity that will allow us to serve our diverse customer segments better and quicker, as well as drive operational efficiency.” “We have recently notified all of our valued customers on this internal reorganisation via email and digital letters. At this point, for all payment transactions - the beneficiary name will now be “TM Technology Services Sdn Bhd” instead of “Telekom Malaysia Berhad”. All other payment details remain the same, such as the bank account and JomPAY code,” Imri added. “The success of TM to shape a Digital Malaysia through technology that empowers communities, businesses and Government truly lies in our Warga TM. With majority of Warga TM realigned into this single operating entity, the individual job functions, entitlements and benefits will remain unchanged. Similarly, all of TM’s current obligations in terms of partnerships, vendor and service agreements will remain in effect.” “We believe this reorganisation will strengthen TM’s role in advancing the country’s digital economy and to serve our growing customers in a more cohesive manner. It will reinforce TM’s competitive edge, solidifying our transition towards being a human-centred TechCo,” Imri concluded.