Financial assistance for underserved local MSMEs from Funding Societies utilising Yellow Pages digital advertising solutions to help with business expansion and sustainability during these challenging times.

Funding Societies Malaysia, the largest peer-to-peer (P2P) financing platform in the country and Southeast Asia recently collaborated with TM Info-Media Sdn Bhd (TMIM), a subsidiary of Telekom Malaysia Berhad (TM) to offer business financing solutions for the underserved and unserved local micro, small and medium enterprises (MSMEs). The mission kicks off into high gear with the prime utilisation of Yellow Pages' digital platform, a product of TMIM and also the leading digital business directory in Malaysia.

The collaboration will provide MSMEs with greater access to digital financing solutions. The solutions will facilitate business expansions as well as ensure sustainability of the MSMEs. It provides vital financing options to existing MSMEs and serves as a launch pad to aspiring entrepreneurs. The synergistic collaboration takes momentous steps towards Funding Societies' mission to improve the livelihoods of MSMEs and TM's role as the enabler of Digital Malaysia.

It also opens the door for as many as 70,000 MSMEs under the Yellow Pages listings to a variety of tailor-made financing products. With the aim of bringing game-changing revolutions to their customers, Yellow Pages Malaysia is no stranger to making innovative transformations in order to stay current in the digital age.

Wong Kah Meng, Co-founder and Chief Executive Officer of Funding Societies Malaysia, commented on the partnership: "Digital financing is becoming more prevalent in Malaysia given its ability to promote financial inclusion, particularly benefiting the MSMEs that are either unserved or underserved by traditional financing avenues by providing easy access to financing solutions. As the largest P2P financing platform in the region, our partnership with TMIM will serve to accelerate our reach in providing the financing support that is much needed by our local MSME players. This is especially relevant given MSMEs are among the most impacted by the Covid-19 pandemic."

Meanwhile, Sean Koh Chin Soon, Chief Executive Officer, TMIM said: "Our Malaysia Yellow Pages platform which has evolved from print to digital, interactive website and mobile app, is the perfect avenue to bridge the MSMEs out there with the resources they require. We are excited to collaborate with Funding Societies Malaysia in empowering local businesses through financial solutions. This will enable them to further expand their potentials thus supporting the sustainability of the businesses, especially during this Covid-19 pandemic. This is also in line with the Government's efforts to boost the growth of Malaysian economy and to propel local businesses. This initiative is befitting of TM Group's unique role in nation building and as the enabler of Malaysia's Digital Nation aspirations."

P2P financing is a digital financing solution that has been gaining traction in recent years. Its modern approach and speedy process makes pain points of traditional financing a thing of the past. Such setbacks including collateral requirement, onerous documentation, slow turnaround time, and high minimum requirements, all posed as hurdles for smaller businesses to obtain quick financing assistance. Through this collaboration, eligible businesses on the Yellow Pages platform can apply for the financing from Funding Societies without even needing to visit a physical branch.

Eligible MSMEs stand to enjoy the following financing benefits from Funding Societies:

- Discount on processing fee

- Fast disbursement with quick approval within five (5) working days

- Flexible tenure of up to 18 months

- No collateral requirement

- Minimal documentation requirement

Besides the collaboration with Funding Societies, TM through its consumer and SME product brand, unifi has also been continuously assisting businesses to stay productive in this emerging digital economy. Via unifi Business Club (uBC) specifically for its SME customers, unifi enables access to complete business solutions which include digital marketing tools, productivity boosters and financial solutions. By allowing businesses to leverage on its strategic partnerships, unifi aims to expedite its customers' recovery and enhance sustainability.

Interested MSMEs can apply for financing from Funding Societies on Yellow Pages website starting 5 October 2020. For more information on the partnership between Funding Societies and TMIM, please visit https://biz.yp.my/solutions/yellowpagesfinancing/.

YOU MAY ALSO LIKE

UNIFI BUSINESS LAUNCHES IMPAK BIZ TO ACCELERATE MSME DIGITAL MATURITY AND UNLOCK GROWTH OPPORTUNITIES

KUALA LUMPUR, 27 AUGUST 2025 – Unifi Business, the preferred digital partner for Malaysia’s micro, small, and medium enterprises (MSMEs), has launched IMPAK BIZ, a strategic initiative to help businesses assess their digital readiness and take clear, practical steps towards becoming more digitally empowered. Launched by YB Datuk Wilson Ugak, Deputy Minister for Digital and available as a complimentary service via biz.unifi.com.my/impakbiz, the digital maturity assessment tool helps MSMEs identify digital gaps and receive focused, actionable recommendations to improve operations, boost productivity, and reach more customers regardless of where they are on their digital journey. The initiative is supported by a strong network of strategic partners, including Malaysia Digital Economy Corporation (MDEC), SME Corp. Malaysia, CTOS, Bank Simpanan Nasional (BSN), Maybank Islamic Berhad, Astro Awani, Rtist, and IPSOS. The initiative anchors on Unifi Business’ trusted, enterprise-grade digital tools and services, which include: Digital consultations with Unifi Business’ Certified Digital Consultants Digital marketing and e-commerce enablement through Unifi Business’ solutions Access to high-speed connectivity and mobile plans via UNI5G Biz IMPAK BIZ also includes support and offerings by Unifi Business’ strategic partners, including: Bank Simpanan Nasional (BSN) – Preferential microfinancing offering with competitive rates, simplified documentation, and streamlined submission processes, among other benefits. Complimentary Halal certification support in collaboration with Maybank Islamic. Free CTOS Business Reports to strengthen financial credibility and decision-making. Creative and marketing services by Rtist talents to enhance brand visibility and outreach. Automatic entry into the IMPAK BIZ Awards, offering national-level recognition and exposure. Shanti Jusnita Johari, Chief Commercial Officer, Unifi said, “MSMEs are central to Malaysia’s digital future. With IMPAK BIZ, we are giving MSMEs a clear starting path forward to digitalise their business and reap its benefits through free digital assessments, access to expert guidance, and tools that improve productivity, financial credibility, and online reach. This initiative is about making digital transformation more practical, inclusive, and achievable for every business, regardless of size or sector.” The launch of IMPAK BIZ reaffirms Unifi Business’ mission to power inclusive digitalisation for MSMEs across the nation and TM’s aspiration to become a Digital Powerhouse by 2030. To get started, MSMEs can visit: https://biz.unifi.com.my

TM Registers Higher Profits in FY2023, Sustaining Resilient Performance

KUALA LUMPUR, 23 February 2024 – Telekom Malaysia Berhad (“TM” or “the Group”), today announced its financial results for the year ended 31 December 2023 (FY2023), with the Group reporting higher revenue and profitability compared to FY2022. This performance reaffirms the Group’s resilience in the competitive market landscape. During the year under review, the Group registered a higher revenue of RM12.26 billion compared to RM12.1 billion in FY2022 propelled by the strong performance of Unifi and TM Global. Specifically, Unifi’s fixed broadband subscriptions experienced a 3.1% growth, reaching 3.13 million, while TM Global’s revenue grew from heightened demand for domestic and international data services. The Group’s Earnings Before Interest and Tax (EBIT) remained flat at RM2.09 billion in FY2023 due to higher operational costs. Meanwhile, the Group’s Profit After Tax and Non-Controlling Interest (PATAMI) rose 63.6% from RM1.14 billion to RM1.87 billion due to a lower net finance cost and tax impact. The Group’s capital expenditure (CAPEX) in FY2023 stood at RM1.9 billion, or 15.9% of its revenue. These investments were primarily aimed at expanding the Group’s network infrastructure nationwide and regional submarine cable system. TM declared a 2nd interim dividend and final dividend totalling 15.5 sen per share amounting to approximately RM594.9 million, demonstrating its commitment to delivering shareholder value. Reflecting on the FY2023 performance, Amar Huzaimi Md Deris, TM’s Group Chief Executive Officer said, “I am pleased to share that TM has sustained its performance amidst challenging regulatory landscapes, heightened competition, and evolving market dynamics. “Our convergence solutions, paired with attractive packages have continued to appeal to our customers, reinforcing our position as the only Fixed Mobile Convergence with quad-play in Malaysia. The ongoing expansion of our nationwide fibre coverage, coupled with the enhancement of our data and network infrastructure, have also contributed to our growth. We remain committed to promoting digital inclusivity and wider digital adoption while addressing the evolving needs of our customers, both domestically and internationally,” said Amar. “Furthermore, 2023 marked the completion of our initial three-year transformation phase during which we have further solidified our position in the local and global telecommunication landscape. Advancing into the next level of our transformation journey, we are now focused on evolving into a Digital Powerhouse by 2030, while positioning Malaysia as a digital hub for the region. Our commitment aligns with the nation’s aspiration of becoming a fully integrated digital society, ensuring that we continue to play a key role in the era of digital innovation,” Amar concluded. Unifi maintains leadership in converged solutions Unifi maintains its leadership in converged offerings of fixed broadband, mobile services, digital content and solutions for both consumers and MSMEs, recording RM5.66 billion in revenue. Unifi’s fixed broadband segment grew 3.1% to 3.13 million subscribers, driven by strategic convergence campaigns and aggressive customer retention efforts. Unifi’s latest offering, the #Unstoppable UNI5G Postpaid and Mobile Family Plans, is designed to enhance the 5G connectivity experience for Malaysians. The newly launched Unifi TV Originals provides a wide array of unique, diverse and locally tailored content for an enriched experience for Malaysian viewers. These further contribute to the Group’s true convergence proposition, providing better value to all customers. As a preferred partner to more than 400,000 MSMEs nationwide, Unifi Business continues to accelerate digital adoption by providing tailor-made solutions, offering them the tools and support needed to thrive in the digital economy. Looking ahead, Unifi will further cement its role as a leader in convergence to deliver unmatched converged digital services. TM One drives innovative solutions for enterprise TM One continues to navigate the market complexities while exploring new growth opportunities. Despite decreased revenue to RM3.14 billion in FY2023, its 4Q23 results showed an increase in revenue of 17.3% versus 3Q23, driven by a surge in solution-based customer projects. TM One has partnered with PLANMalaysia to equip 29 city councils with smart technologies for sustainable and connected urban environment. It was also appointed as the preferred converged digital infrastructure partner for the Sarawak Digital Economy Corporation (SDEC) to materialise aspirations towards the growth of Sarawak’s digital economy. Moving forward, TM One is poised to remain at the forefront of supporting and enabling the digital infrastructure for both government entities and enterprises. With a focus on innovation and strategic partnerships, TM One is set to play a significant role in Malaysia’s digital transformation journey. TM Global positions Malaysia as a digital hub for the region TM Global posted a solid financial performance in FY2023. Its revenue rose 8.7% to RM3.10 billion, primarily from an increase in international data revenue, driven by managed wavelength services for hyperscalers, alongside an uptick in domestic data services. In the domestic landscape, TM Global continues to expand 5G backhaul sites and High-Speed Broadband (HSBB) Access coverage in accelerating digital inclusivity nationwide. Globally, it recorded a year-on-year 30Tbps bandwidth growth and delivered a mega requirement of more than 35Tbps long-term leased connectivity for US-based hyperscaler. TM Global will continue to broaden its digital infrastructure solutions and forge strategic alliances with global carriers to position Malaysia as a digital hub for the region, facilitating seamless digital connectivity and services across borders.

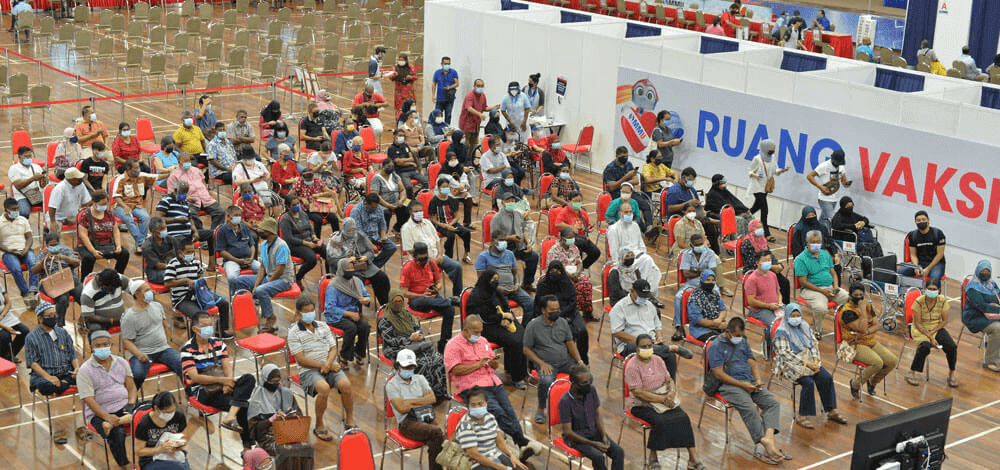

TM supports national Immunisation Programme with MMU Cyberjaya and Melaka as PPV venues and TM rovers volunteers

Multimedia University (MMU) Cyberjaya campus becomes an Integrated Mega Vaccine Delivery Centre (PPV), in addition to MMU Melaka to further accelerate the national Immunisation Programme. Telekom Malaysia Berhad (TM) further strengthens its support of the National COVID-19 Immunisation Programme (PICK) when its university, Multimedia University (MMU) Cyberjaya campus began its operations as an Integrated Mega Vaccine Delivery Centre (PPV) facility starting 15 July 2021. This further complements the operations of MMU Melaka campus as a PPV since mid-June. The Integrated Mega PPV at MMU Cyberjaya campus will be able to accommodate the administration of 3,000 doses of vaccine per day. Combined with the Melaka campus, both PPV facilities have the capacity to cater for 3,600 doses of vaccine daily. In addition to these facilities, TM also deployed more than 30 TM Reaching Out Volunteers (ROVers) amongst its Warga TM to lend a helping hand at Mega PPV Bukit Jalil starting 12 July 2021. This will be extended to more venues progressively. Commenting on the support, Imri Mokhtar, Group Chief Executive Officer, TM said: "We believe our responsibility to help the nation curb the pandemic goes beyond our role as an essential service provider. We are very honoured that both our MMU campuses in Cyberjaya and Melaka have been selected to be PPV facilities. Together with the deployment of our TM ROVers volunteers, this is our undivided commitment to further accelerate the national Immunisation Programme so we can help achieve herd immunity for the nation faster." TM also runs its own internal drive to encourage its employees to register for vaccination and to date, more than 80% of Warga TM has registered for the national immunisation programme and 51% of them have been vaccinated or at least have an appointment set for their first dose. "TM remains fully supportive of the Government's recovery plan. We continue to ensure Malaysians are connected in the safety of their homes and that all our customer support services are in operation throughout each phase of the recovery plan. As the enabler of Digital Malaysia, we will support all our customer segments across homes, businesses, industry as well as the public sector with connectivity and digital infrastructure and solutions towards economic recovery. We join all Malaysians in prayer for our safety and health nationwide; please continue to stay safe and ensure that we get vaccinated – together may we return stronger," he concluded.